The programme

The programme

Action 3 - Digital Transformation of Cutting Edge SMEs concerns companies that have already integratedICT in many of their operations and are now seeking to implement integrated investments in cutting edge technologies or 4th industrial revolution solutions.

The main objective of Action 3 - Digital Transformation of Cutting Edge SMEs is the upgrading of SMEs with cutting edge technologies or advanced digital systems of the 4th industrial revolution and, in addition, the coverage of individual needs in

information and communication technologies (ICT)

that enhance their productivity and competitiveness.

The Action encourages, as a priority, the implementation of targeted digital transformation investment projects that contribute to an outward-looking, innovative, competitive and sustainable critical production of higher value-added products and services.

Who it concerns

Who it concerns

The basic eligibility requirements for businesses applying for funding are as follows at the date of online submission of the funding application:

1. Να υποβάλλουν μία (1) επενδυτική πρόταση ανά ΑΦΜ.

2. To are active in the Greek territory and invest exclusively in a single Regional Category / Regional Unit having the same aid intensity.

3. Adhere to Simple or double-entry books and have closed at least one (1) full fiscal year.

4. Have at least one (1) eligible activity code, at the time of submission of the funding application.

5. Be active in the eligible CDR of the investment project for at least one (1) year.

6. The investment project must relate exclusively to the eligible CSDs of this action (eligible sectors of activity under Reg. ΕΕ 651/2014 (ΓΚΑΚ) και 1407/2013 (De Minimis)).

7. Have At least nine (9) PTEs of paid employment in the calendar year preceding the submission of the funding application.

8. To no work has been started on the investment project before the aid application is submitted.

Σε αντίθετη περίπτωση:

If the application for funding has been submitted under the financial scheme of the Rule. ΕΕ 1407/2013 (de minimis), the expenditure is considered ineligible and is therefore rejected.

If the application for funding has been submitted under the financial scheme of the Rule. ΕΕ 651/2014 (ΓΑΚ), the entire investment project becomes ineligible for financing.

9. To collect a minimum of 70 in the digital maturity questionnaire of this call for proposals.

Επιπρόσθετα θα πρέπει να πληρούνται στο σύνολό τους οι κάτωθι προϋποθέσεις κατά την ημερομηνία ηλεκτρονικής υποβολής της αίτησης χρηματοδότησης:

10. To have the status of an SME according to the SME definition of EU Recommendation 2003/361/EC, taking into account the conditions for maintaining this status.

11. Here. operate legally and have the appropriate operating licence in accordance with the legislation in force.

12. Να λειτουργούν αποκλειστικά με μία από τις ακόλουθες μορφές επιχειρήσεων: επιχειρήσεις εταιρικού/εμπορικού χαρακτήρα [Ανώνυμη Εταιρία, Εταιρία Περιορισμένης Ευθύνης, Ομόρρυθμη Εταιρία ή Ετερόρρυθμη Εταιρία, Ι.Κ.Ε, ατομικές επιχειρήσεις και Κοινωνικές Συνεταιριστικές Επιχειρήσεις του Ν. 4430/2016 όπως ισχύει, Ναυτιλιακή Εταιρεία Πλοίων Αναψυχής (ΝΕΠΑ)]. Επίσης, επιλέξιμες είναι και οι δικηγορικές εταιρείες του άρθρου 49 επ. του Ν. 4194/2013.

13. To meet the conditions of application of the EU Regulation on which the financial support scheme is based, which they will be obliged to choose when submitting their application for funding. There is a choice of either Kan. EU 651/2014 (GDPR) or Reg. EU 1407/2013 (De Minimis).

14. Not be in bankruptcy, liquidation or administration.

15. Not to have pending recovery of state aid following a decision of the European Commission declaring an aid illegal and incompatible with the internal market.

16. To collect a minimum total score of 50 in the scoring criteria which will relate to the description of the investment plan submitted, the number of employees (NTE) and the digital maturity of the business. (Τμήμα Β Βαθμολογούμενα Κριτήρια Αξιολόγησης)

The following enterprises are not eligible to apply for investment project funding (applies regardless of the funding scheme - Reg. EU 651/2014 or Reg. EU 1407/2013 - to be selected):

- Public undertakings, public bodies or public institutions and/or their subsidiaries, the Legal Entities under Public Law (NPAs), as well as companies in whose capital or voting rights the OTAs and all the above public bodies participate, directly or indirectly, with a percentage of more than twenty-five percent (25%), individually or jointly (as well as companies that are assimilated to them, as main partners)

- From businesses that are part of an already organised uniform product distribution network or service providers and which operate, under relevant contracts, licences to exploit intellectual property rights, usually involving trademarks or distinctive titles and know-how for the use and distribution of goods or services (e.g. franchising, shop-in-shop, agency network, etc.).

- Οι εξωχώριες (offshore) επιχειρήσεις.

- Enterprises whose principal activities fall within NACE Rev . 2 or to enterprises engaged in intra-group activities whose principal activities fall within Classes 70.10 'Activities of head offices' or 70.22 'Business and other management consultancy activities' of NACE Rev. 2.

- Firms belonging to the exempted undertakings from Kan. EU 651/2014 and EU Regulation 1407/2013 sectors as described in Annex X "GATS requirements" & IX Annex "De minimis conditions" respectively of this document. In the case of enterprises operating in the sectors listed in the above items and also operating in one or more of the eligible activity codes, Regulation 651/2014 & Regulation 1407/2013 shall apply to aid granted to the eligible activities provided that there is a separation of activities or cost segregation, that the activities in the sectors excluded from the scope of these regulations do not receive aid.

Please note that:

- Clustering of businesses is not allowed. The term co-location means the establishment of the business in the same, non-distinct premises as another business. In the event that a clustering of businesses is found to exist, the integration decision will be revoked.

- businesses with the beneficiary's residence (primary or secondary) are not accepted.

- In the case of mergers or acquisitions, all previous de minimis aid already granted to any of the merging firms shall be taken into account in determining whether the new de minimis aid to the new or acquiring firm exceeds the relevant ceiling. De minimis aid that was legally granted before the merger or acquisition remains legal (it concerns wage cost aid under EU Regulation 1407/2013).

- Where an undertaking is split into two or more separate undertakings, de minimis aid granted before the split-up shall be imputed to the undertaking which received the aid, which is normally the undertaking which took over the activities for which the de minimis aid was used. If such imputation is not possible, the de minimis aid must be allocated pro rata on the basis of the book value of the equity of the new companies on the effective date of the split-up (for aid for wage costs under EU Regulation 1407/2013).

Additional participation requirements

Financing under the aid scheme of Reg. EU 651/2014

For the cases of choice of Reg. EU 651/2014 (GATS), the following conditions must - in addition to the general conditions - be met in their entirety on the date of online submission of the funding application:

1. Not to be a problem business, according to EC 1058/2021. By way of derogation, firms that were not in difficulty on 31 December 2019 but became in difficulty during the period from 1 January 2020 to 31 December 2021 shall not be considered to be in difficulty.

2. Provide at the time of submitting the application for funding an Affidavit with evidence of private participation of at least 25%. Private participation must not involve any element of State support.

3. The investment projects to be supported under Commission Regulation (EU) No 651/2014 of 17 June 2014 (OJ L 187/26.6.2014), Article 14, must have the character of an initial investment, as defined in Article 13 "Scope of regional aid" and Article 14 "Regional investment aid" of Regulation (EU) No 651/2014:

- Setting up a new business establishment.

- Expansion of the capacity of an existing plant. The additional capacity of the plant resulting from the investment project can only be accepted if the existing capacity of the plant can be certified by official documentation.

- Diversification of a unit's production into products or services that have never been produced in it

- Fundamental change of the entire production process of an existing unit.

4. The conditions for the application of Reg. EU 651/2014 (GAK), as mentioned in Section 5 "SELECTED ACTIVITIES - SELECTED BUSINESSES" of this document and the conditions of Annex X "GAK conditions". In the event that undertakings opt for the aid scheme under Reg. EU 651/2014 (GAK) to confirm that, during the two years preceding the application for aid, they have not relocated to the business premises where the initial investment for which aid is requested will take place, and they undertake not to do so within a maximum period of two years after the completion of the initial investment for which aid is requested (only for companies applying under Article 14 of Reg. EU 651/2014).

5. For investment projects to be submitted under the financial scheme of Reg. EU 651/2014, and in particular Article 14 thereof, it applies that the investment must be maintained in the area where the aid is granted for at least three years after its completion. This shall not prevent the replacement of equipment which has become obsolete or damaged during that period, provided that the economic activity is maintained in the area concerned for the relevant minimum period.

Financing under the aid scheme of Reg. EU 1407/2013 (De Minimis)

For the cases of choice of Reg. EU 1407/2013 (De Minimis), it must - in addition to the general conditions - be fulfilled that the total amount of de minimis aid received in the past by the undertaking (single enterprise) concerned, including aid from this Action, does not exceed €200,000 (or €100,000 for the road freight transport sector on behalf of third parties) in a three-year period (current financial year and the two (2) previous financial years prior to the year in which the legal right to the aid was granted).

Digital maturity ranking of the company

Each applicant company must meet a minimum level of digital maturity based on the level of existing technologies, applications and equipment in operation. The ranking is based on the criteria of the following digital maturity questionnaire which aims to connect businesses with appropriate services, equipment and systems that upgrade their digital operation.

|

DIGITAL MATURITY QUESTIONNAIRE

|

|

A/A

|

Equipment-Logic in Operation

|

Full Coverage

Criterion

|

Contributor

|

|

1

|

Enterprise Resource Planning (ERP) or Customer Relationship Management (CRM) applications or Applications

stock and warehouse management system (WMS)

|

Yes/No

|

30%

|

|

2

|

Electronic data exchange applications (Electronic

Data Interchange) between businesses (B2B) or with customers

(B2C)

|

Yes/No

|

30%

|

|

3

|

Data storage and management software; and

backup, in the form of cloud computing (cloud) or local servers (hosts servers)

|

Yes/No

|

15%

|

|

4

|

Business intelligence applications for data analysis and presentation (Business Intelligence and Data

Analytics)

|

Yes/No

|

25%

|

|

|

total

|

|

100%

|

On the basis of the above criteria, firms are awarded a score of 100 if they fully meet the criterion in question or 0 points if they do not fully meet the criterion in question.

The final ranking score (K) of the beneficiaries ranges from 0 to 100 points according to the following formula:

K= Criterion 1*0,3 score + Criterion 2*0,3 score + Criterion 3*0,15 score + Criterion 4*0,25 score

Applications from companies with a K score of less than 70 may not be submitted.

The correct completion of the questionnaire is documented by the digital submission of the corresponding supporting documents by the beneficiary when submitting the funding application. The correctness of the questionnaire is confirmed by the NF during the evaluation.

If the verification of the supporting documents reveals that the company is ranked at a digital maturity level K lower than 70, the investment project is rejected.

The company must maintain at least the digital maturity it has at the time of submitting the funding application until the date of completion of the physical and financial scope of the investment project.

Program budget

Program budget

The budget of this Action amounts to a total amount of €60.000.000 (Public Expenditure) and is allocated to the regions of the country

The minimum and maximum total supported budget (M/F) of the funding application is set from €200.001 to €1.200.000.

The subsidised budget of the investment project may not exceed three times the highest turnover achieved in one of the three (or less if the enterprise does not have three) financial years preceding the year in which the application for funding is submitted.

In the event that the funding application has a budget above the ceilings, the excess budget will be covered in full by a private contribution from the promoter of the investment.

The Public Expenditure is co-financed by the European Regional Development Fund (ERDF) of the European Union and by National Participation.

Amount of subsidy

Amount of subsidy

The aid rates for investment projects and the private participation of the aid beneficiary for all the aided expenditure of the investment projects are, where applicable, as follows:

According to the EU Regulation 1407/2013 (De Minimis)

The aid rates of the investment projects and the private participation of the beneficiary of the aid for all the supported expenditure of the investment projects under the financial instrument are as follows:

|

Aid intensity (De minimis)

|

|

Regions

(for all the regions of the country)

|

Public Grant (Community and National)

Up to (%)

|

Private Participation

(%)

|

|

Medium Enterprises

|

Small & Very Small Businesses

|

Medium Enterprises

|

Small & Very Small Businesses

|

|

50%

|

50%

|

50%

|

50%

|

|

For the Fair Transition Areas

|

60%

|

60%

|

40%

|

40%

|

Fair Transition Areas:

Regions: West Macedonia, B. Aegean, N. Aegean, Crete,

Municipalities: Megalopolis, Gortynia, Tripoli, Oichalia

Please note that the total amount of de minimis aid received by a single enterprise, including aid under this measure, must not exceed EUR 200 000 (or EUR 100 000 for the transport sector) in any three-year period (current calendar year and the two (2) previous calendar years) preceding the year in which the aid is granted.

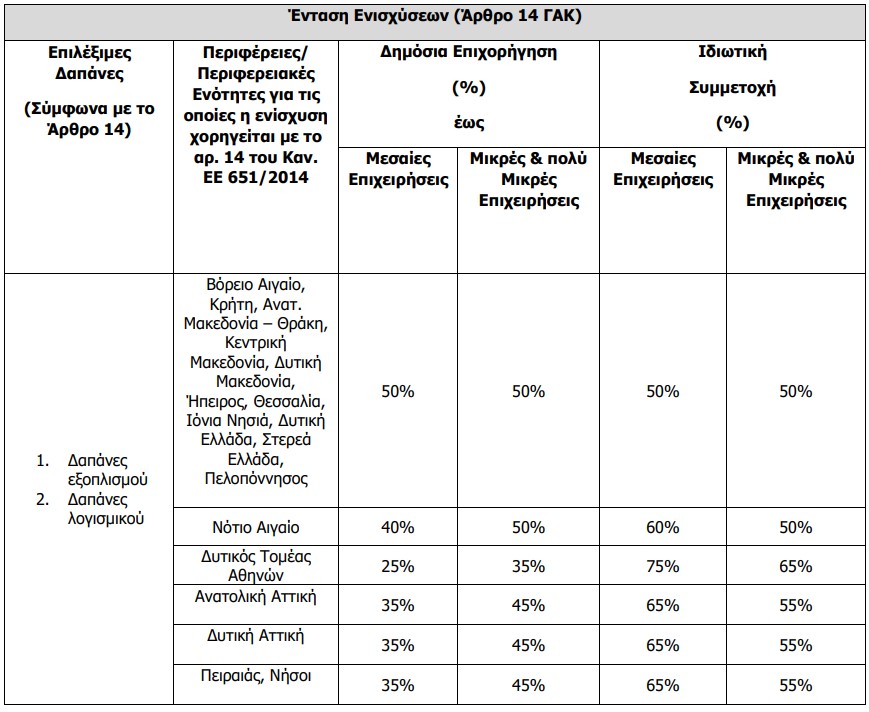

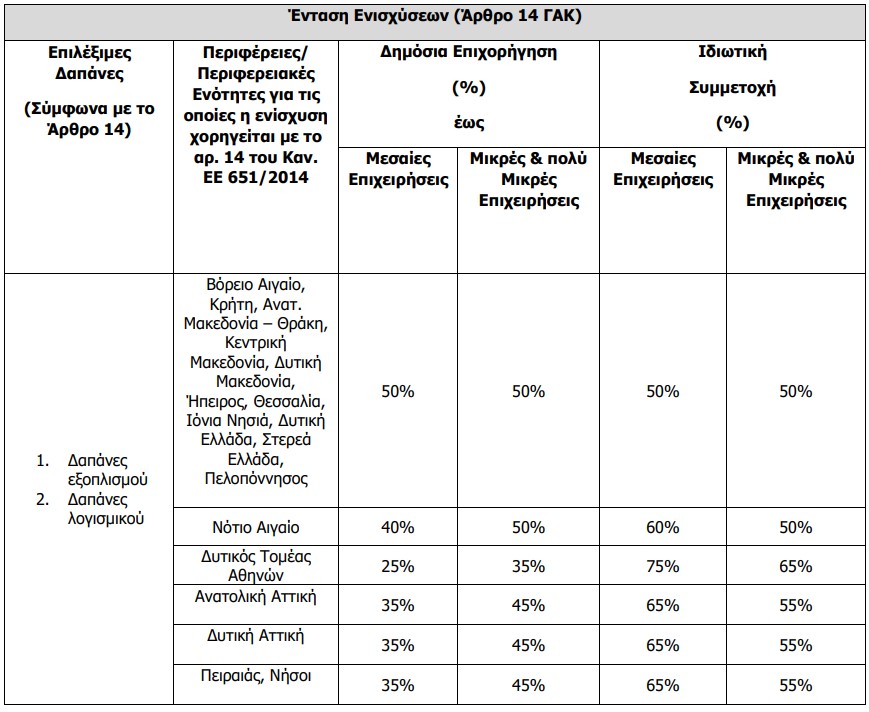

According to the EU Regulation 651/2014 (GDPR)

In case the aids follow the frameworkof Article 14 "Regional Investment Aid" of the GAC, their intensities are as follows (Regional Aid Map 2022-2027):

Please note that investment projects under Article 14 of Reg. EU 651/2014 must have the character of an initial investment and in particular one of the following must be met:

1) Setting up a new business establishment.

2) Expansion of the capacity of an existing plant. The additional capacity of the unit

due to the investment project can only be accepted if the existing

capacity of the plant can be verified by official documentation.

3) Diversification of a unit's output into products or services that have not been produced

ever in it.

4) Fundamental change of the entire production process of an existing plant.

Please note that the aid intensity, expressed in gross grant equivalent, does not exceed the maximum aid intensity specified in the regional aid map 2022-2027.

In case the aid follows the framework of Article 18 "Regional Investment Aid" of the GER, the aid intensities are as follows:

|

Aid intensity (Article 18 GER)

|

|

Eligible expenditure (according to Article 18)

|

Public subsidy

(Community and National)

(%)

until

|

Private Participation (%)

|

|

|

Medium Enterprises

|

Small & Very Small Businesses

|

Medium Enterprises

|

Small & Very Small Businesses

|

|

1. Costs for provision of services

|

50 %

|

50 %

|

50%

|

50 %

|

Please note that the aid intensity will not exceed 50 % of the eligible costs.

Expenses subsidized

Eligible costs

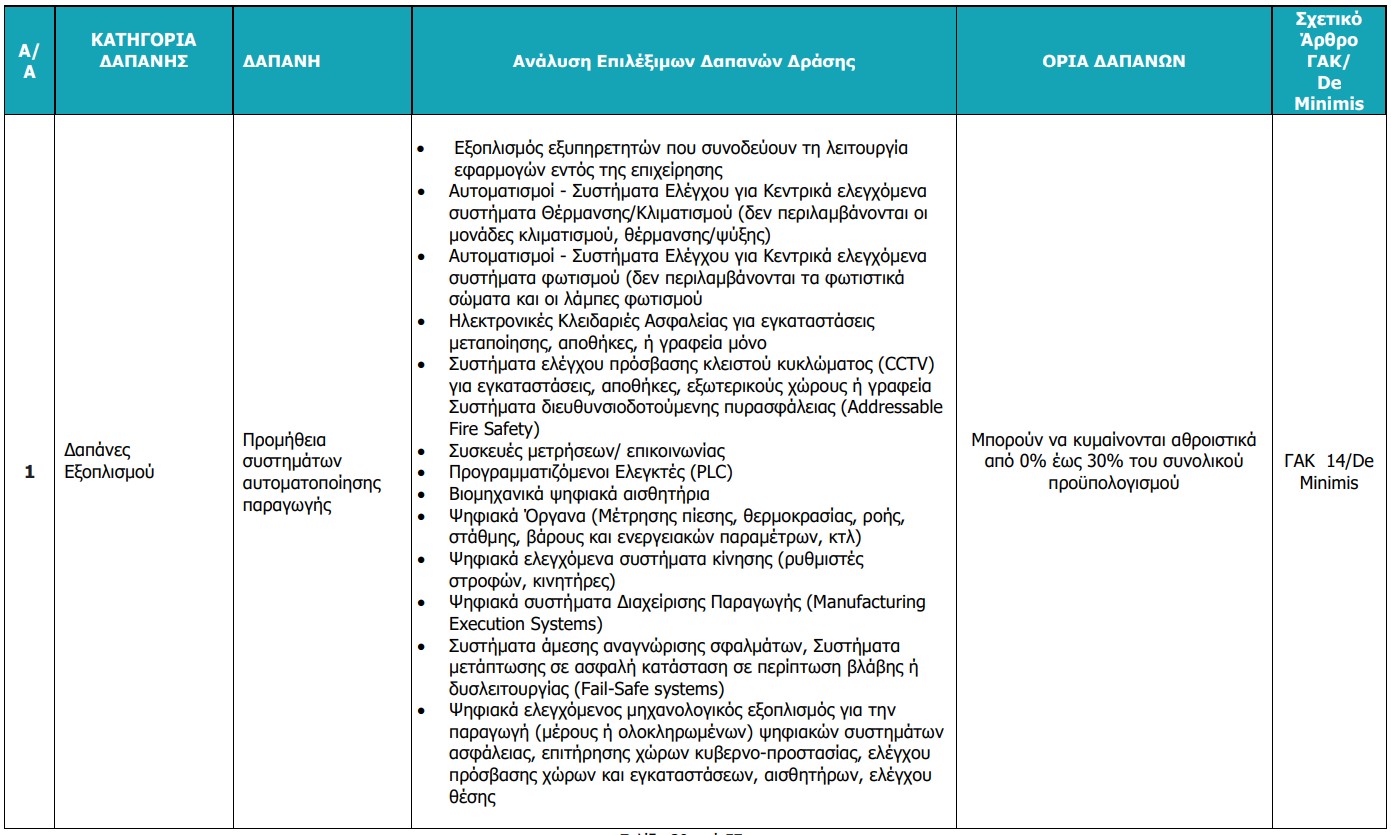

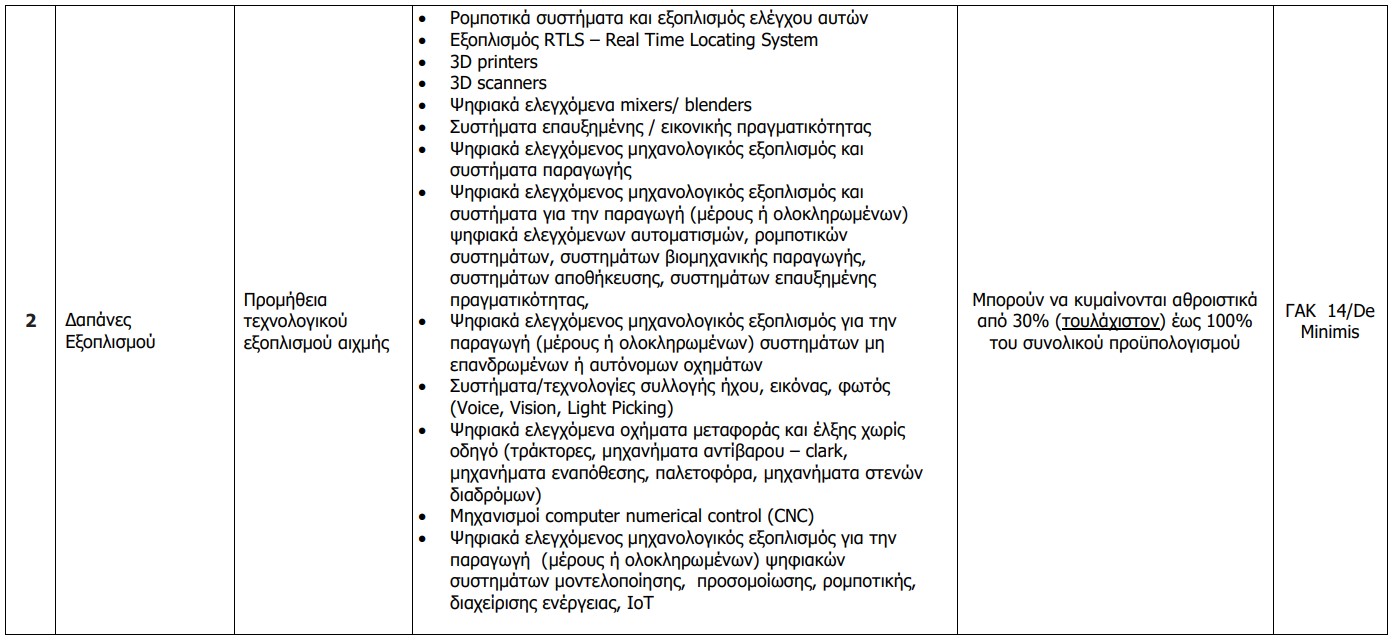

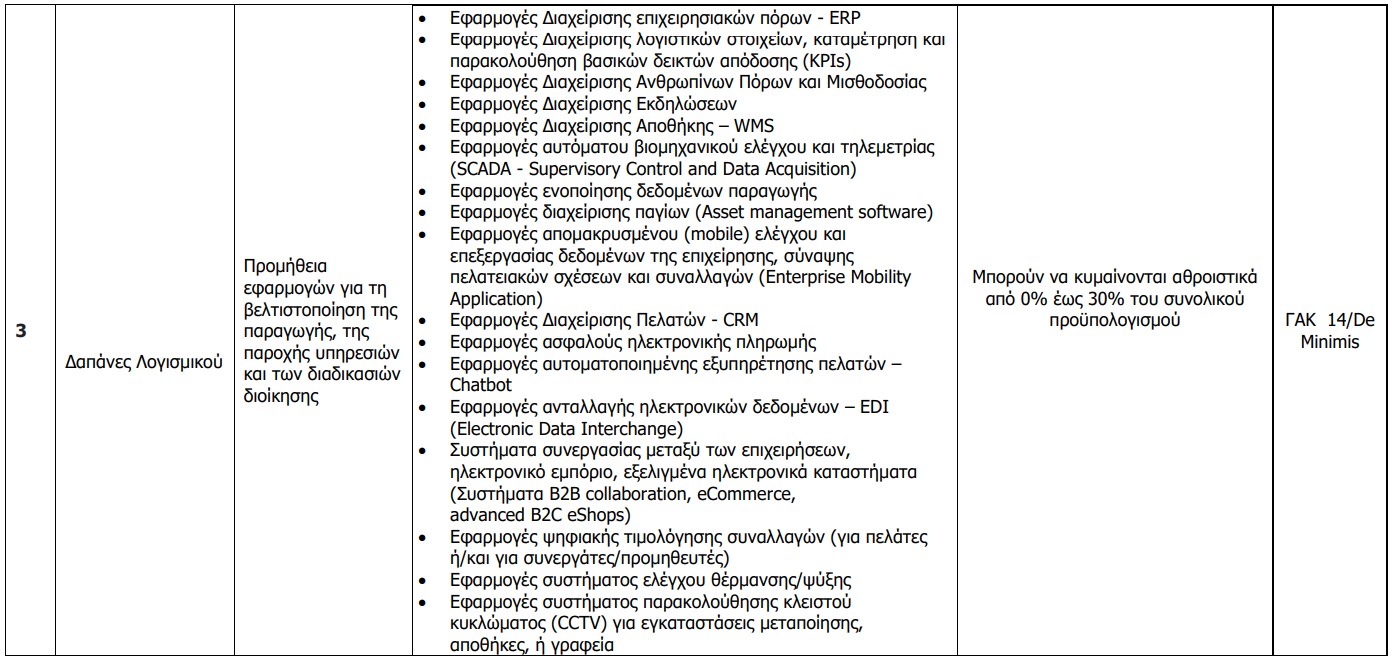

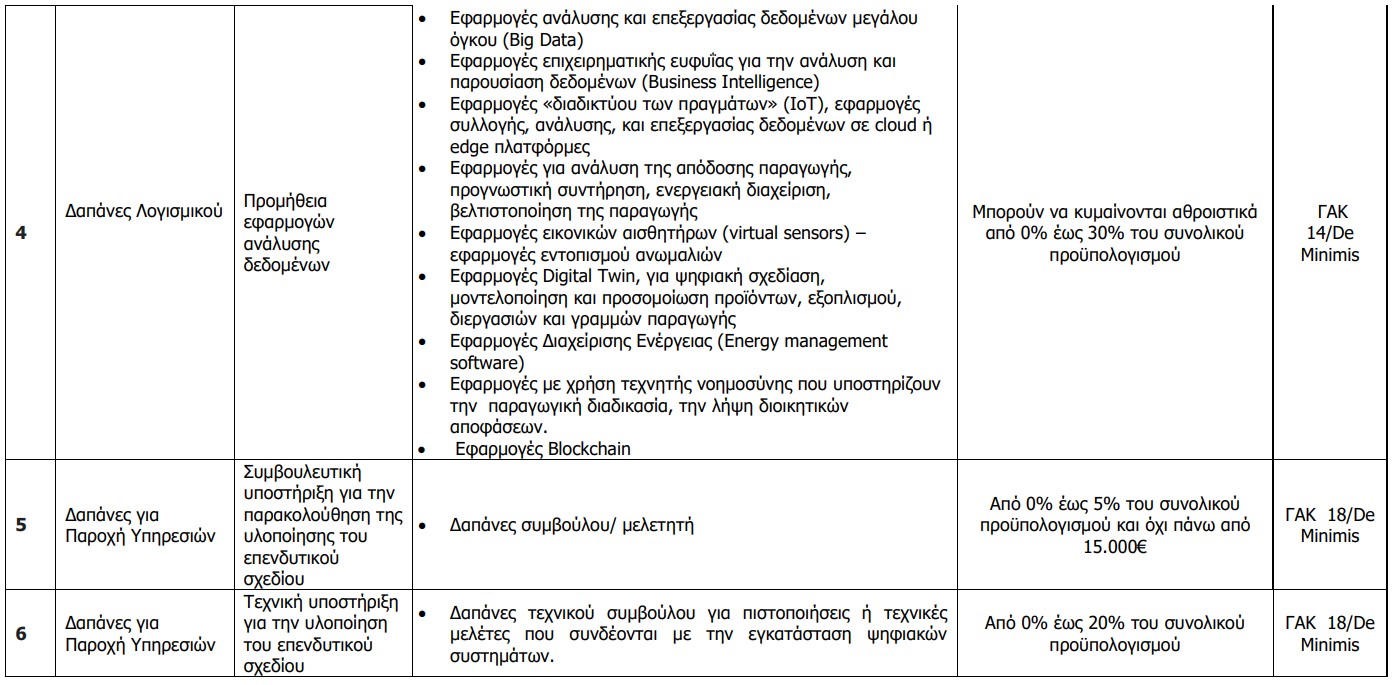

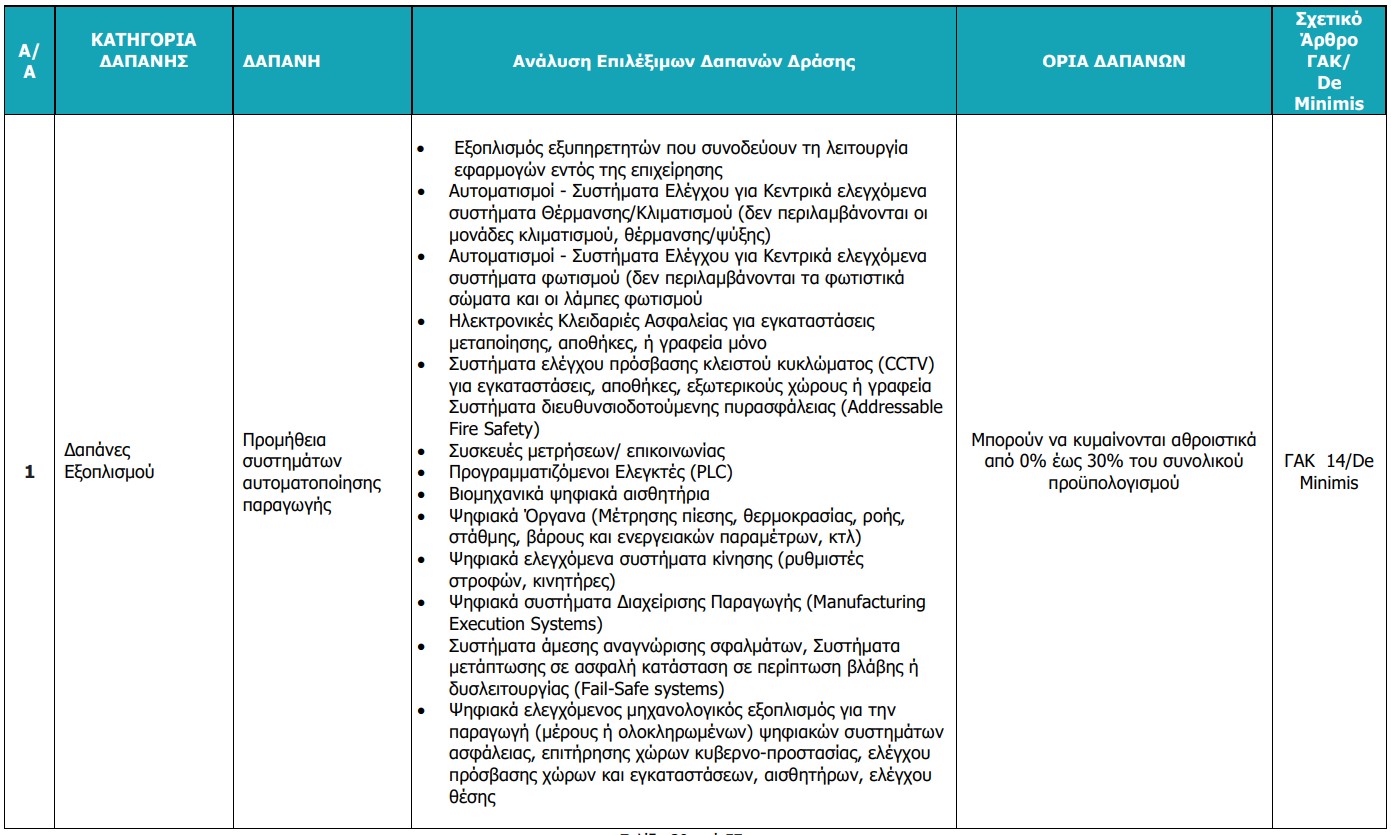

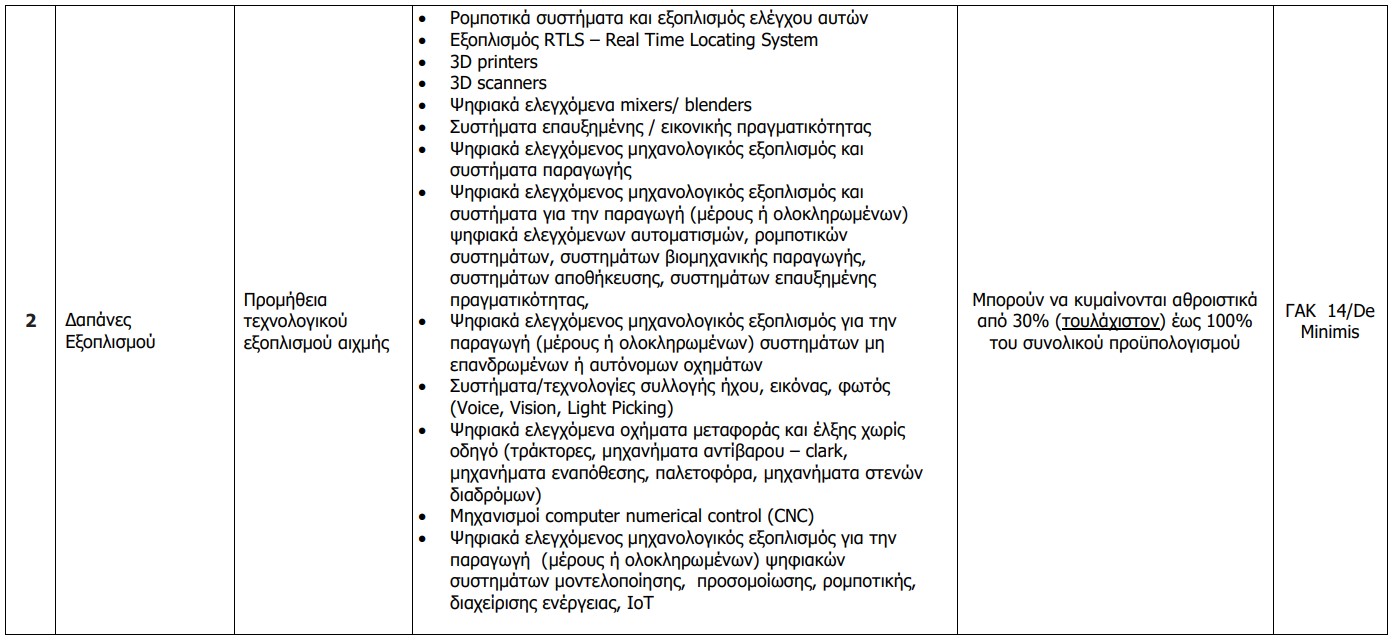

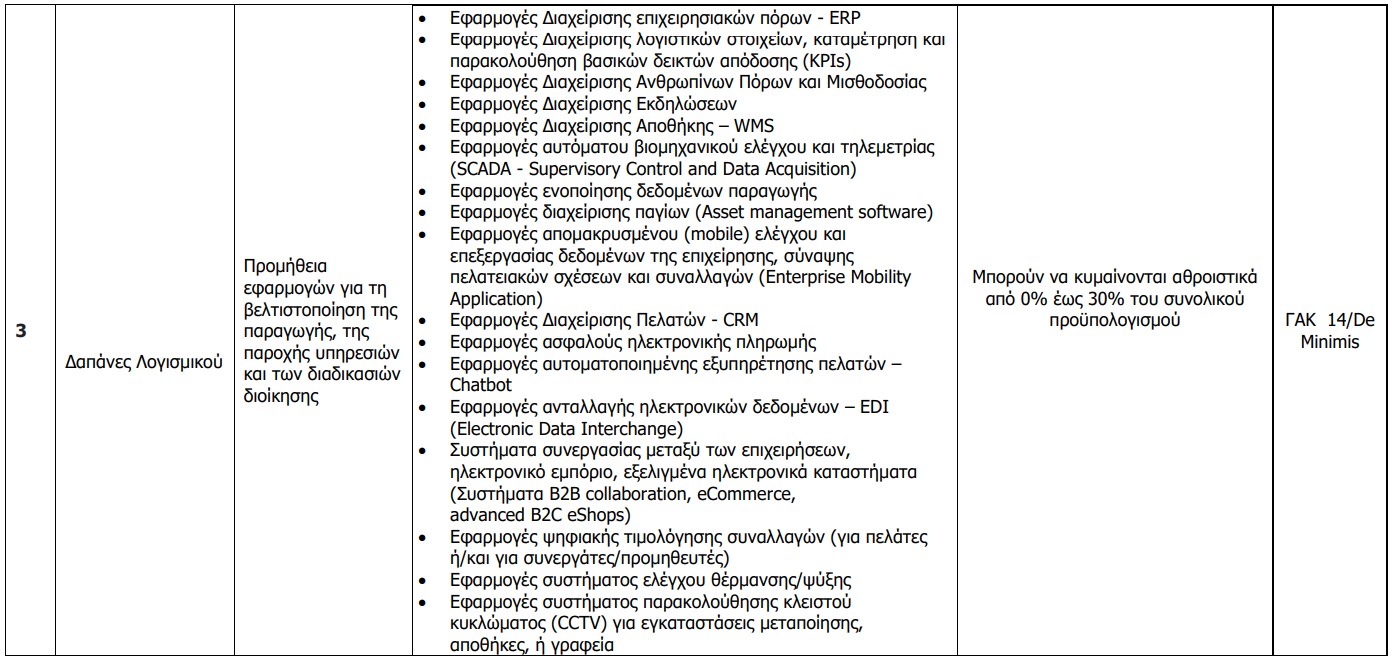

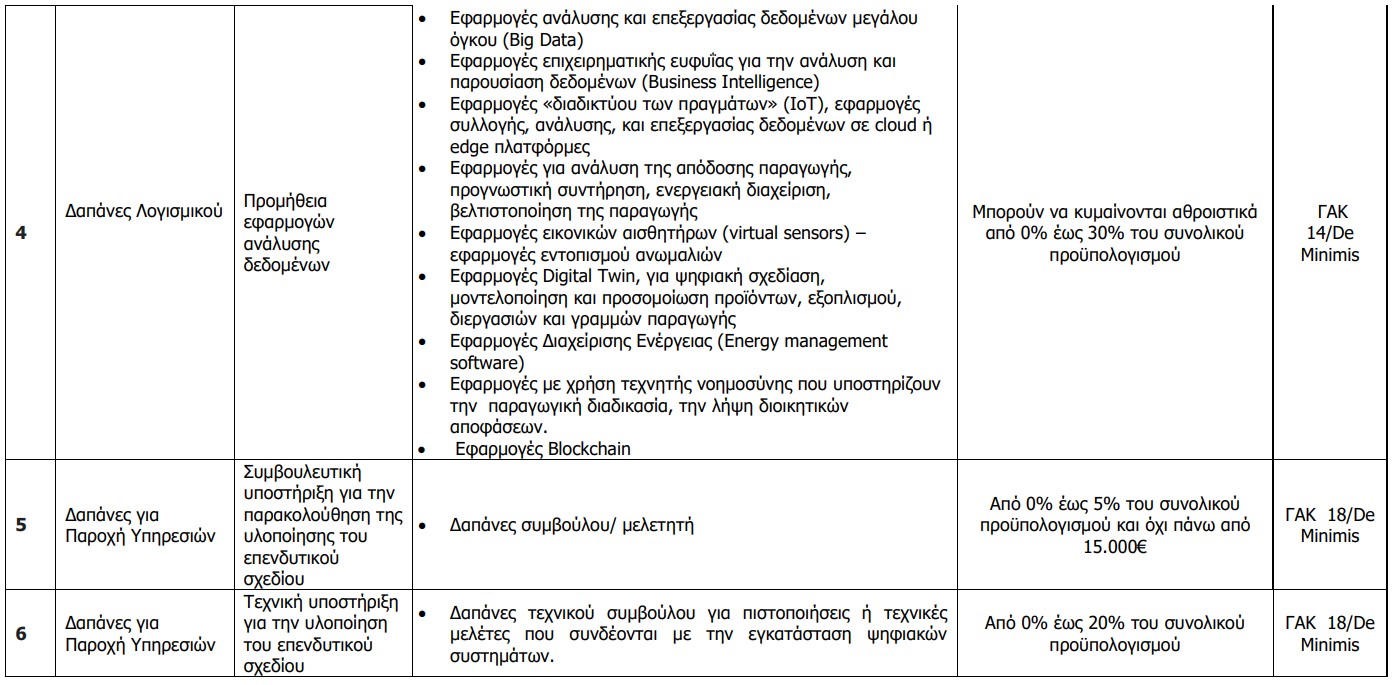

The main categories of expenditure covered by Action 3 - Cutting Edge Digital Transformation

SMEs are the following:

1) Equipment costs with indicative costs: Supply of advanced systems for remote plant operation, automation of the various stages of the value chain (production - transport - storage), production / storage / transport with robotic systems, upgrading of internal data transfer networks, interaction with employees, customers or suppliers, supply of advanced technological systems and engineering equipment for the production of Industry 4.0. systems and equipment, security systems and equipment (e.g. site surveillance, cyber-protection, etc.), systems and equipment, systems and equipment for the production and use of data and information systems, systems and equipment for the production of data and information systems.

2) Software expenditure with indicative expenditure: Procurement of applications for increased intelligence in administrative and financial planning, digital security, customer and supply chain management, data analysis with artificial intelligence tools, production optimisation, upgrading of services, etc.

3) Expenditure for the provision of services related to the digital upgrade with indicative costs: Consulting and technical support for the configuration and integration of the new systems into the operation of SMEs, certification of systems, etc.

Please note that the expenditure for "Supply of cutting-edge technological equipment" of the category "Equipment expenditure" should constitute at least 30% of the total budget of the investment project.

Eligible expenditure will receive aid in the form of a grant. They are common to both funding schemes that the beneficiary can choose, i.e. De Minimis (EU Regulation 1407/2013) or GAC (EU Regulation 651/2014) and concern:

α) Investment expenditure on intangible and tangible assets (Article 14 EU Regulation 651/2014 and EU Regulation 1407/2013) in the following categories of Expenditure:

- Equipment expenditure

- Software expenditures

b) Expenditure

consultancy and support services

(Article 18 EU Regulation 651/2014 and EU Regulation 1407/2013) in the following categories of Expenditure:

- Expenditure on the provision of services

The following is a breakdown of the eligible costs of the Action:

The date of eligibility of expenditure shall be the date of submission of the application. In case of expenditure before the date of submission of the application:

- If the application for funding has been submitted under the financial scheme of the Rule. ΕΕ 1407/2013 (de minimis), the expenditure is deemed ineligible and therefore the expenditure is rejected.

- If the application for funding has been submitted under the financial scheme of the Rule. ΕΕ 651/2014 (ΓΑΚ), the entire investment project becomes ineligible for financing.

Important dates

Important dates

Opening date: 23/02/2023 at 12:00

The Action will remain open until the budget is exhausted.

Applications for funding will be evaluated through the direct procedure (FiFo) in order of priority, according to the date/time of online submission (finalization) at

OPSKE

.

The date of eligibility of expenditure is defined as the date of submission of the application. In the case of expenditure incurred before the date of submission of the application:

- - If the application for funding has been submitted under the financial scheme of the Rule. ΕΕ 1407/2013 (de minimis), the expenditure is deemed ineligible and therefore the expenditure is rejected.

- - If the application for funding has been submitted under the funding scheme of the Rule. ΕΕ 651/2014 (ΓΑΚ), the entire investment project becomes ineligible for financing.

The maximum duration of the completion of the physical and economic scope of the investment project may not exceed eighteen (18) months from the date of adoption of the Decision of Inclusion.

Necessary supporting documents for submission

Απαραίτητα δικαιολογητικά

15/02/2023

Application documents

Χρήσιμα αρχεία

Χρήσιμα αρχεία

15/02/2023

Προκήρυξη Δράσης

15/02/2023

Application documents

15/02/2023

Eligible nace code

07/11/2022

Pre-publication of Action 3 - Cutting Edge Digital Transformation of SMEs