Development Law

Greece Strong Development, N. 4887/2022

The purpose of the Development Law is to promote the economic development of the country by granting incentives to specific activities and sectors, in order to achieve the digital and technological transformation of businesses, the green transition, the creation of economies of scale, the support of innovative investments and those seeking to introduce new technologies of "Industry 4.0", robotics and artificial intelligence, the enhancement of employment with qualified personnel, the support of new entrepreneurship, the support of the development of new businesses, the enhancement of the employment of skilled personnel, the support of the development of new businesses, the support of the creation of new jobs, the support of the creation of new jobs, the support of the development of new businesses, the support of the creation of new jobs, the support of the development of new businesses

The main objective is to provide a comprehensive framework of incentives with the key objective of creating business initiatives for existing, start-up or incipient enterprises intending to make an initial investment in one of the following eligible ways:

- Create a new unit

- Capacity expansion of an existing unit

- diversification of the production of an establishment into products that have never been produced or services that have not been provided by it, provided that the aided expenditure exceeds by at least two hundred percent (200%) the book value of the assets re-used, as recorded in the fiscal year preceding the application for the investment project

- Fundamental change of the entire production process of an existing unit. On large enterprises, it is also required that the aided investment expenses exceed the depreciation of the assets, which are related to the activity to be modernized and occurred during the three (3) previous tax years. If the depreciation associated with the activity is not clearly disclosed, the above condition is deemed not to be met

Aid schemes

Αντικείμενο είναι η θέσπιση καθεστώτων για τη χορήγηση κρατικών ενισχύσεων σε επενδυτικά σχέδια, τα οποία μπορούν να εμπίπτουν στις ακόλουθες κατηγορίες:

- Digital and technological business transformation,

- Green transition – Environmental upgrading of enterprises,

- New Business,

- Fair Development Transition Regime,

- Research and applied innovation,

- Agri-food – primary production and processing of agricultural products – fisheries and aquaculture,

- Manufacturing – Supply chain,

- Business extroversion,

- Strengthening tourism investment,

- Alternative forms of tourism,

- Large investments,

- European value chains,

- Entrepreneurship 360º

Who it concerns

Eligible are companies that are established or have a branch in Greek territory at the time of commencement of the investment project and have one of the following forms:

- sole proprietorship, with a maximum eligible investment project cost of two hundred thousand (200,000) euros only for the scheme “Agri-food – primary production and processing of agricultural products – fisheries and aquaculture.”

- trading company,

- cooperative,

- Social Cooperative Enterprises (SPs) of 4430/2016 (A 2015)), Agricultural Cooperatives (AC), Producer Groups (POs), Agricultural Corporate Partnerships (ACPs) of Law 4384/2016 (A 78),

- companies being formed or merged, with the obligation to have completed the disclosure procedures before the start of work on the investment project,

- joint ventures engaged in commercial activities

- public and municipal undertakings and their subsidiaries, provided that:

- they are not entrusted with the service of a public purpose,

- they are not exclusively entrusted by the State with the provision of services,

- their operation shall not be subsidised from public funds for the period during which the long-term commitments referred to in Article 22 are fulfilled.

The following are not eligible and are excluded from aid under this scheme:

- undertakings which are subject to pending aid recovery proceedings at the time of the submission of the investment project application (Deggendorf principle),

- firms in difficulty, as defined in paragraph 18 of Article 2 of the General Tax Code (Article 1(4)(c) of the General Tax Code),

- enterprises which, during the two (2) years preceding the submission of the application for aid, have relocated to the business premises where the initial investment in respect of which aid is requested will take place or have not undertaken not to do so within a period of two (2) years after the completion of the initial investment for which aid is requested,

- enterprises implementing investment projects carried out on the initiative and on behalf of the State, on the basis of a relevant contract for the execution of a project, concession or provision of services.

Beneficiaries - Eligible activities

- Hotels and camping of at least 3 star category

- Health tourism and medical tourism

- Manufacturing / Industry

- Agri-Nutrition

- Energy

- Supply Chain/Logistics

- Τουριστικά λιμάνια/Υδατοδρόμια

- Special Tourist Infrastructure Facilities: conference centres, golf courses, tourist ports, ski resorts, theme parks, spa tourism facilities (thermal therapy units, thermalism centres, thalassotherapy centres, spa centres), sports tourism training centres, mountain refuges, motorways

Recovery and rehabilitation centres - Fields (4×4, 5×5, etc.) and swimming pools

- Information and Communication Technologies (ICT)

Types of aid

o Tax exemption (exemption from the payment of income tax on the pre-tax profits realised, which arise under the relevant tax legislation, from all the activities of the company, minus the tax of the legal person or legal entity on the profits distributed or assumed by the partners) The investing entity may use the entire amount of the tax exemption aid to which it is entitled within fifteen (15) tax years from the year in which the right to use the benefit is established

o Leasing subsidy, which consists of the State covering part of the leasing instalments paid for the acquisition of new machinery and other equipment. The leasing subsidy may not exceed seven (7) years

The subsidy is paid semi-annually and after each payment of the instalments of the rent by the investor.

o A grant, which consists of the free provision by the State of a sum of money to cover part of the supported costs of the investment project and is determined as a percentage of these costs

Aid rates

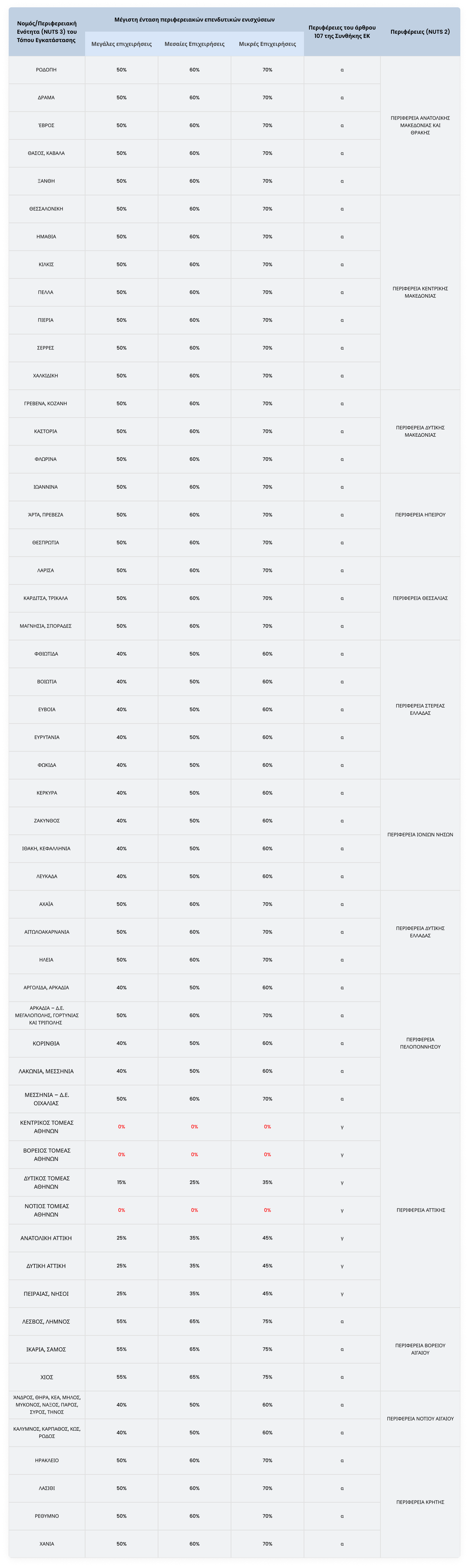

MAP OF REGIONAL AID IN GREECE (FROM 1/1/2022 TO 31/12/2027)

Definition of enterprise size

Medium-sized enterprise: an enterprise which employs fewer than 250 persons and has an annual turnover of less than EUR 50 million or a balance sheet total of less than EUR 43 million

Small enterprise: an enterprise which employs fewer than 50 persons and whose annual turnover or annual balance sheet total does not exceed EUR 10 million

Very small enterprise: an enterprise which employs fewer than 10 persons and whose annual turnover or annual balance sheet total does not exceed EUR 2 million

Restrictions

- The total amount of aid per submitted investment project can reach up to €10,000,000

- Το συνολικό ποσό της ενίσχυσης ανά υποβληθέν επενδυτικό σχέδιο μπορεί να φθάσει τα 10.000.000 ευρώ. ευρώ για μεμονωμένη επιχείρηση και τα 30 εκ. for all related and cooperating undertakings

- These restrictions shall apply to investment projects which are subject to the present and for a period of three (3) years from the submission of the entity’s application for inclusion of the investment project in the

- The ceilings are increased by 50% where the aid is granted in the form of a tax exemption

Minimum amount of investment projects

- EUR 1.000.000,00 for large companies

- EUR 500.000,00 for medium-sized enterprises

- 250.000,00 euros for small businesses

- EUR 100.000,00 for micro enterprises

Evaluation criteria

The scoring criteria are divided into four (4) groups:

A.Maturity of the Investment Plan 0-10 points

Β. Evaluation of the Financial Scheme 0-25 points

C. Evaluation of the Investment Plan Entity 0-25 points

D. Investment Plan Assessment 0-40 points

The minimum score required for each investment project to be included in the ranking tables is 50 points.

A.Maturity of the Investment Plan 0-10 points

Β. Evaluation of the Financial Scheme 0-25 points

C. Evaluation of the Investment Plan Entity 0-25 points

D. Investment Plan Assessment 0-40 points

The minimum score required for each investment project to be included in the ranking tables is 50 points.

Implementation of approved investment projects

Requests for verification/certification of expenditure may be submitted by the investing entity at the following stages:

- If a grant has been selected, an amount of up to 25% of the approved grant may be paid to the beneficiary by

- implementation of a project amounting to at least 25% of the total cost of the investment

- Certification of the implementation of 50% of the physical and financial scope of the investment project

- Certification of the implementation of 65% of the physical and financial scope of the investment project

- Certification of completion and start of productive operation of the investment