Two years have passed since August 2021, when Greece received its first pre-financing payment from the Recovery Fund (RRF) resources. Since then, a significant part of the Fund's actions have focused on upgrading the business sector, both in terms of digital and green transition and in terms of broader competitiveness enhancement.

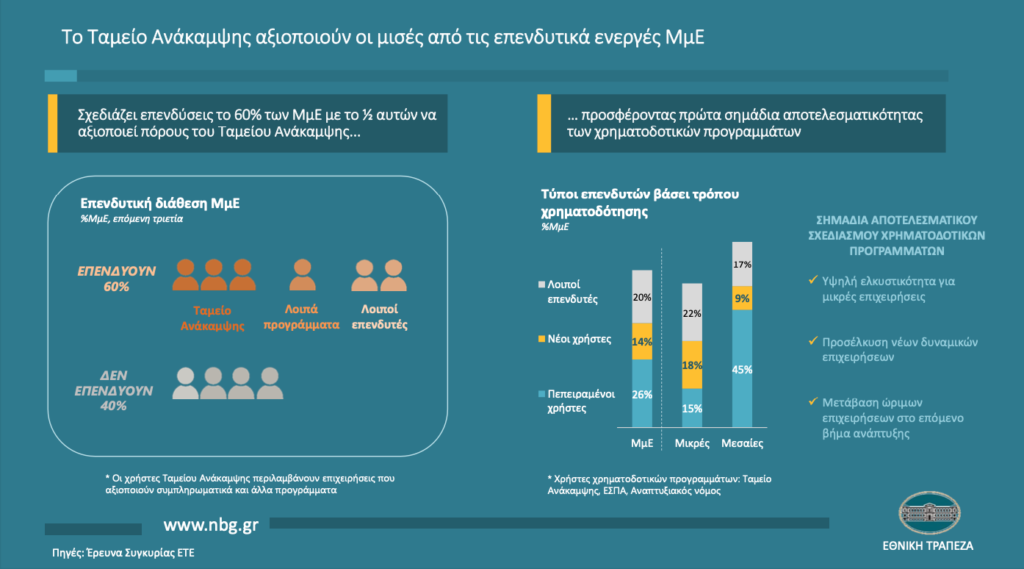

In this context and building on regular field research, the Economic Analysis Division of the National Bank of Greece is examining the utilisation of the Recovery Fund resources by SMEs. The main finding of the analysis is the identification of early signs that the sector is benefiting, directly and indirectly. The role of the design of the investment programmes proves to be crucial, as they seem to achieve the dual objective of attracting 'new' users and leading 'old' users to the next stage of their development.

The role of the Recovery Fund appears to be important in a complex environment:

- (i) enhanced investment appetite (with 60% of SMEs planning to invest compared to 40% in the previous three years); and

- (ii) an intensifying contractionary monetary policy

What the data show

Indeed, the half of SMEs with active investment plans (27% of the total sector) is targeting or already using relevant resources, creating balanced financing structures of equity, loans and grants. In this context, investment interest is beginning to take on a practical dimension, with the percentage of SMEs that have applied to the Recovery Fund to approach 11% in the first half of 2023 (14% in medium sized companies), while the gradual reduction of inflationary pressure on raw materials is expected to activate an even larger part of investors in the coming months. More importantly, despite the relatively high complexity of the Fund's procedures, there seems to be no lag in the progress of investment implementation.

Specifically, 6% of SMEs wishing to invest through the Recovery Fund are already in the implementation stage while afurther 7% have advanced plans (with the corresponding percentages for "investors" outside the Fund being at similar levels, around 8%). It is worth noting that the Fund's support is directed towards all categories of investments (from green and digital to innovation and partnerships), covering about half of each, highlighting its balanced design.

Recovery Fund - Positive impressions

Apart from the obvious mobility around the Recovery Fund, the current context is characterised by a wider range of investment instruments, with the redesign of the NSRF and Development Fund to have enhanced their attractiveness for SMEs. In this context, the reading of the first data leaves a positive impression in terms of the effectiveness of all available investment programmes:

- Given the desire of 60% of SMEs to invest, it is important that 25% of them (14% of the total) will use investment programmes for the first time (through the Recovery Fund, NSRF or Development Fund). This shift largely reflects the improved design of these tools, in a way that improves their usability, especially for smaller businesses (18% new users for small vs. 9% for medium-sized businesses).

- At the same time, the attraction of the most dynamic enterprises as new users is a further indication of the effective design of the funding programmes. In particular, new users seem to be mainly firms that have had a high investment momentum in the past three years (with an average 8% increase in fixed assets), which the majority (63%) plan to intensify further in the next three years.

- As far as 'old' users are concerned, the design of the programmes also appears to be effective, as it largely succeeds in pushing them to the next step. With already strong sales (+5% p.a. in the past three years) and high extroversion (14% of foreign sales), experienced users are more oriented towards productivity improvements (through facility upgrades, digital and green investments) than capacity expansion investments.

While the first signs of the effectiveness of the investment programmes are positive, it is equally important to underline that the beneficial action of the Recovery Fund in the SME sector is not limited to facilitating the implementation of its investment projects. At the same time, financing much of the infrastructure planned in the country, helps SMEs indirectly, with more than 2/3 of them expecting significant benefits from this upgrade. Combining all of the above with the fact that Greece is third in the EU in terms of absorption of funds (36.4%, compared to the European average of 30.6%), there are reasonable expectations for a the remarkable footprint of the Recovery Fund to the real economy, by strengthening the country's business fabric.