The programme

The programme

The present Action 2 - Green Productive Investment for SMEs encourages small investment projects aimed at the use and development of modern technologies, the upgrading of the products and/or services produced and their activities in general, by favouring actions that make use of modern technologies, infrastructure and best practices in

energy upgrading

, the circular economy and the adoption of clean sources.

Who it concerns

Who it concerns

Existing medium, small and micro enterprises can submit a proposal to the Green Productive Investment SME Action .

The basic conditions for the participation of potential beneficiaries are the following:

- Make an investment exclusively in one Category of Region

- Have at least one (1) full closed administrative use of prior to the date of online submission of the funding application.

- Be substantially active (Principal Activity Code or Highest Revenue Activity Code) in one (1) eligible Activity Code of this call prior to the date of online submission of the funding application.

- Have the eligible investment ID(s) of this call for proposals before the date of online submission of the application for funding.

- Have at least two (2) FTEs of paid employment in the calendar year preceding the submission of the funding application. This will be confirmed on the basis of the declared data kept for this undertaking in the ERGANI information system.

In addition, you should:

- Indicate as the place(s) for the implementation of the actions of this action only one category of Region. It should be specified that the undertaking may carry out expenditure at its head office and/or at its branches, provided that all the places of implementation belong to the same category of region and have the same aid intensity

- To operate legally having the appropriate licensing document, in accordance with the applicable legislation and their activity (e.g. operating license, operating licence, opening declaration, operating licence exemption, opening notification, etc.). In case the licence has not been issued or has expired, the relevant application for its issue/renewal is required.

- Not be in bankruptcy, liquidation or administration, or have not filed a petition for reorganization by the company's creditors.

- Not have pending recovery of state aid following a decision of the European Commission declaring an aid illegal and incompatible with the internal market.

- The physical object of the investment has not been completed or has not been fully implemented before the submission of the application for funding.

Δεν έχουν δικαίωμα υποβολής αίτησης χρηματοδότησης:

- Public enterprises, public bodies or public organisations and/or their subsidiaries, legal persons governed by public law, as well as companies in the capital or voting rights of which the OTAs and all the above public bodies participate, directly or indirectly, with a percentage of more than twenty-five percent (25%), individually or jointly (as well as companies that are assimilated to them, as main partners).

- Offshore companies, financial and insurance institutions, as well as all kinds of sports clubs, associations, sports joint stock companies, as well as companies related to the above categories in any way (indicatively: parent, subsidiary, affiliated, associated, cooperating, joint ownership/management through natural persons, etc.)

Please note that:

- Clustering of businesses is not allowed, so that the equipment of the aided investment cannot be used by another undertaking. The term 'co-location' means the establishment of the assisted firm in the same, indistinguishable premises as another firm.If it is found that the firms are co-located where the equipment of the assisted investment can be used by another firm, the decision to grant the aid will be revoked.

- Businesses with the place of implementation being the Beneficiary's residence (primary or secondary) are not eligible.

Program budget

Program budget

The total budget of the Green Productive Investment SME Action amounts to 400.000.000€ (Public Expenditure).

The subsidised budget of each investment project ranges from 30.000€ to 200.000€.

The subsidised budget of the investment project may not exceed twice the highest turnover achieved in one of the three (or less if the enterprise does not have three) management periods of the year preceding the submission of the application for funding, witha maximum of 200.000€.

The Action is co-financed by the European Union, in particular by the

European Regional Development Fund (ERDF)

and by the Greek State.

Amount of subsidy

Amount of subsidy

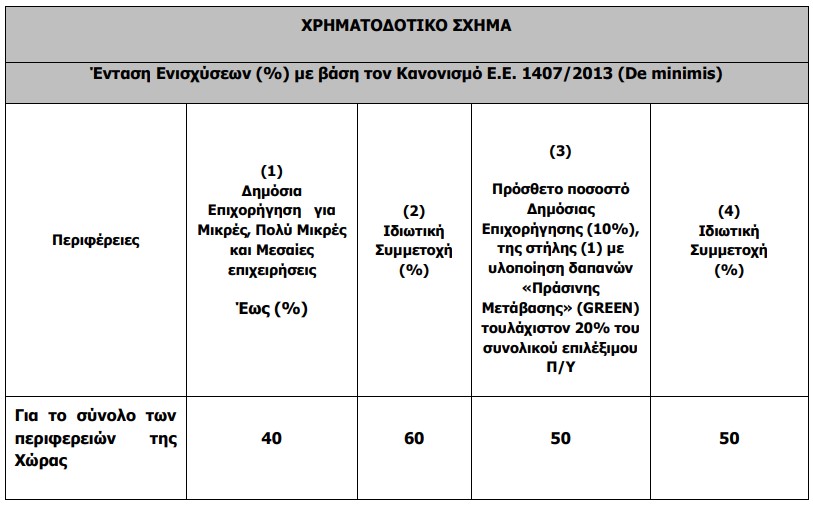

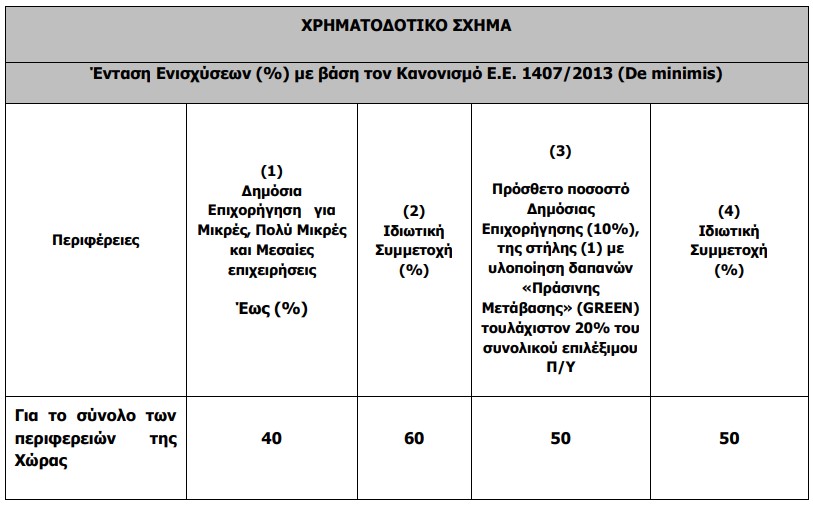

The aid under this Action will be made available under the CommissionRegulation (EU) No 1407/2013 of 18 December 2013 on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid (De Minimis).

The rate of aid is set as follows:

The percentage of the grant may be increased by 10% upon the inclusion of the investment project, which will be attributed at each stage of certification of the physical and economic scope.

The bonus is confirmed if"Green Transition" expenditure (GREEN expenditure) of at least 20% of the total eligible budget of the investment project is incurred and certified at the final verification stage.

Expenses subsidized

Expenses subsidized

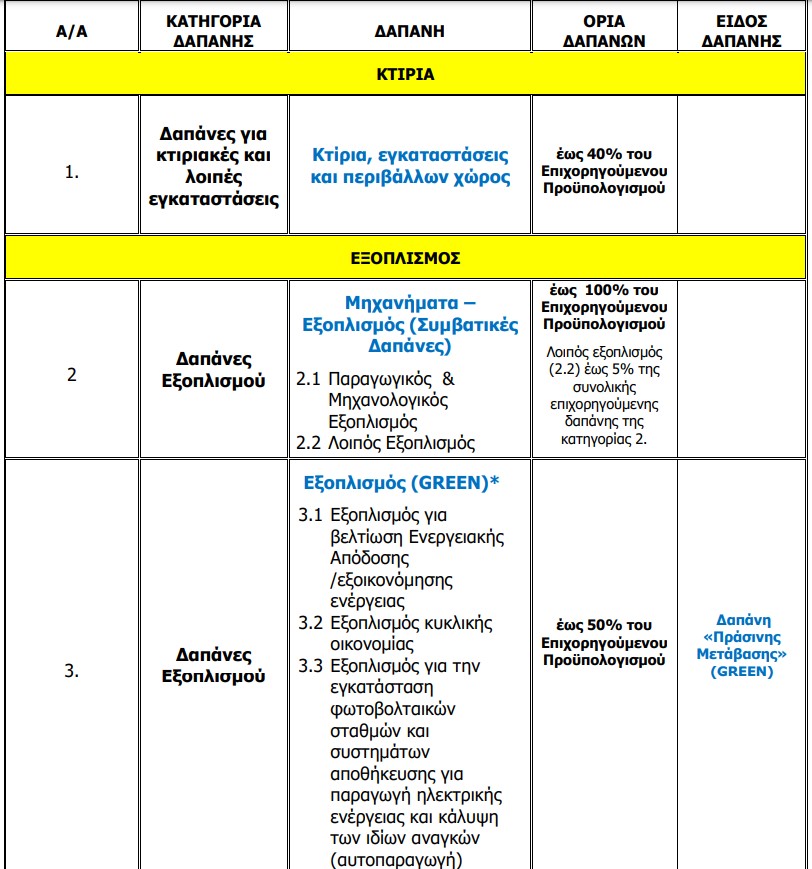

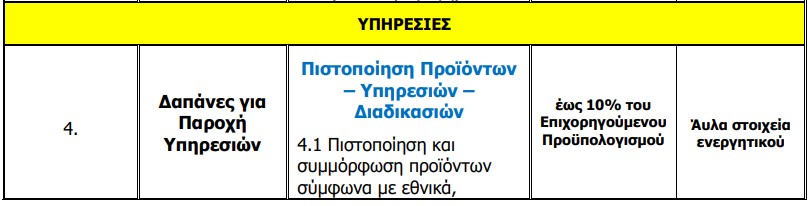

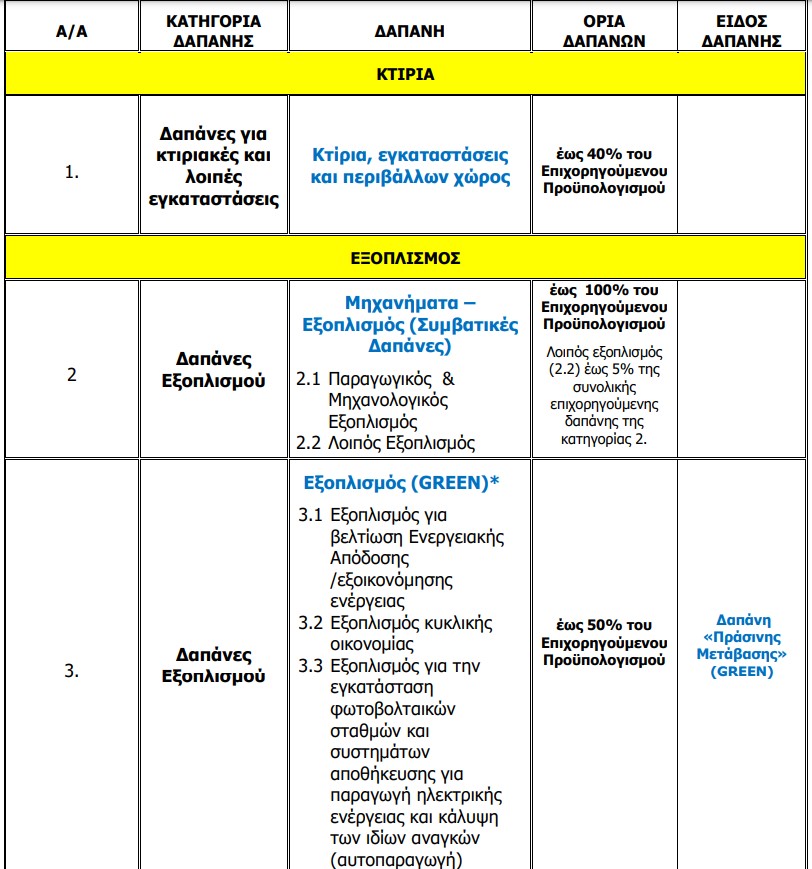

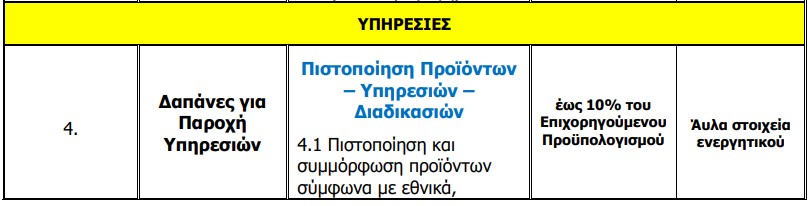

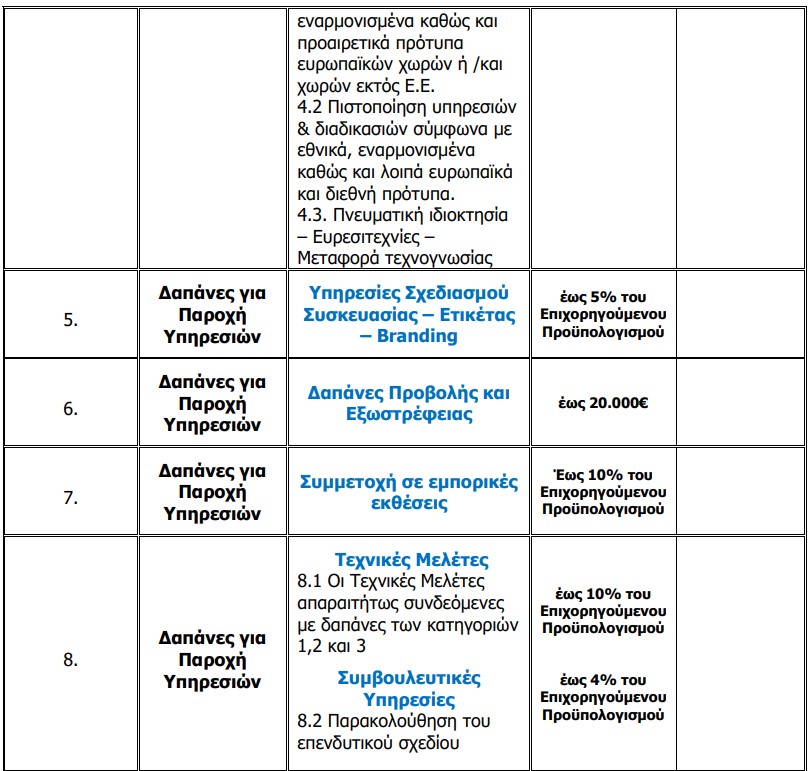

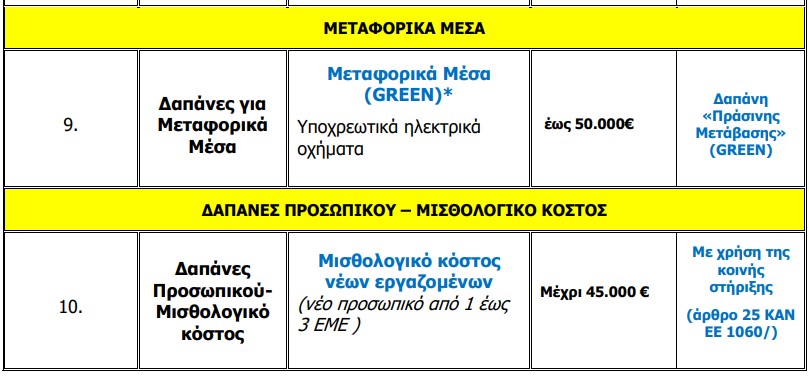

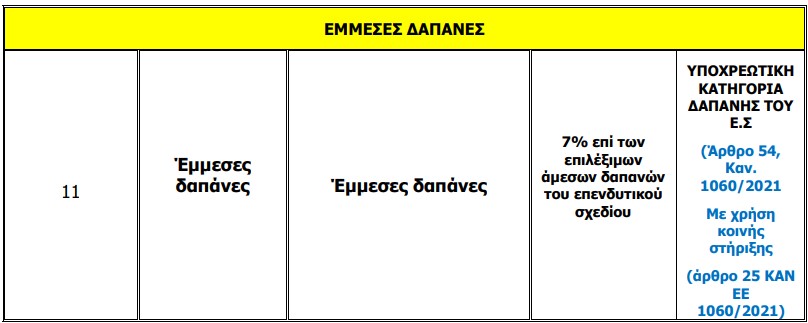

To formulate the budget of the investment projects to be financed under the Action, The eligible basic categories of expenditure are the following:

I. wildings, fakilites ed surudings

II. Προμήθεια και εγκατάσταση νέων σύγχρονων μηχανημάτων και εν γένει εξοπλισμού, απαραίτητου για τη λειτουργία της επιχείρησης και την άσκηση της οικονομικής δραστηριότητάς της (Contractual Costs).

III. Supply and installation of equipment to improve energy efficiency - energy saving and environmental protection (Green Transition Expenditure/GREEN).

IV. Certification of products, services and processes according to national, harmonized and optional standards of European countries and/or non-EU countries (standards of destination countries).

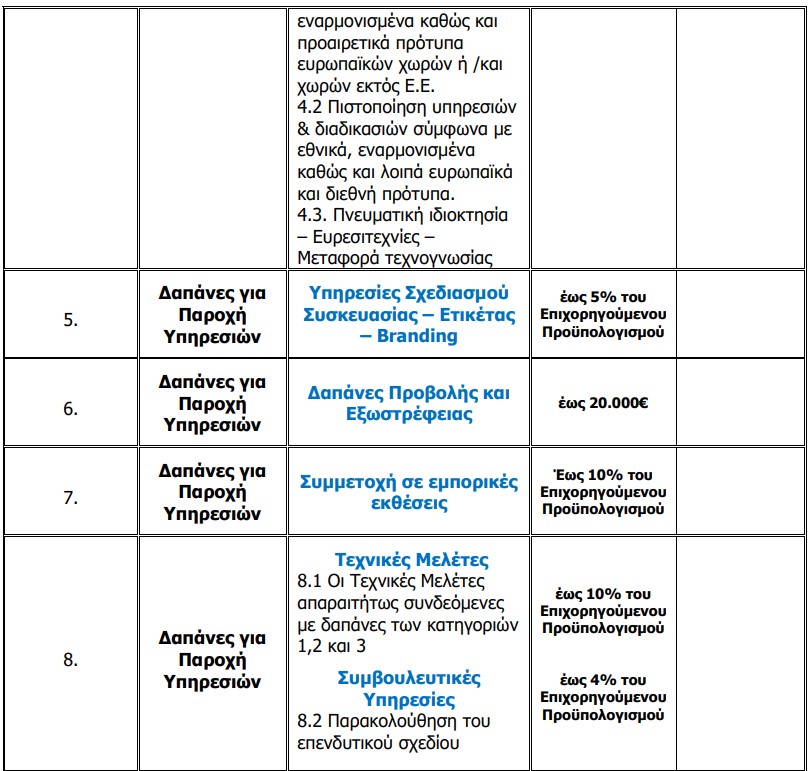

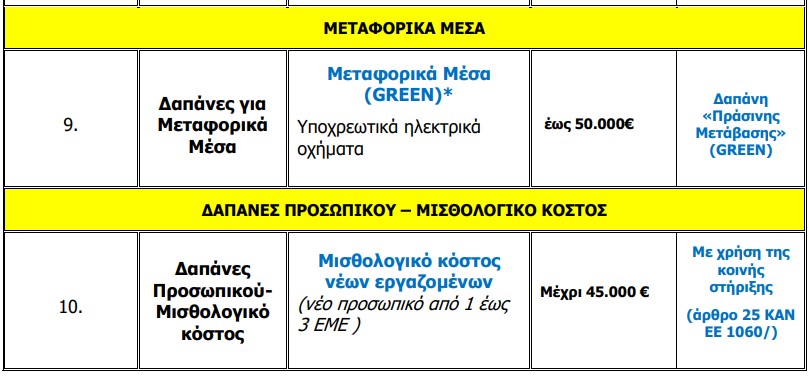

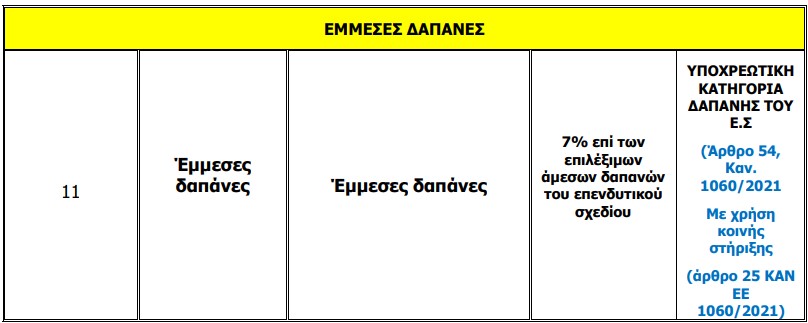

In addition, support is provided for expenditure on: (a) salary costs of newly recruited staff, (b) technical studies, (c) digital promotion, (d) means of transport and (e) consultancy services for the monitoring of the investment project, (f) participation in trade fairs, (g) indirect costs.

In detail, the categories of eligible costs are:

The date on which expenditure is eligible is the date of submission of the application for funding.

You can also find more information on the Green Transformation action.

Important dates

Important dates

Opening date: 22/03/2023 at 12:00

The Action will remain open until the budget is exhausted.

Applications for funding will be evaluated using the direct procedure (FiFo) in order of priority, according to the date/time of electronic submission (finalisation) in the OPSKE.

The start date for eligibility of expenditure is defined as the date of submission of the funding application.

The maximum duration of completion of the physical and economic scope of the investment project may not exceed twenty-four (24) months from the date of adoption of the Decision of Inclusion.

Requests for extension of the implementation may be submitted upon documented justification and the maximum up to six (6) months from the deadline of twenty-four (24) months.

Necessary supporting documents for submission

Απαραίτητα δικαιολογητικά

07/03/2023

Application documents

Applications for funding will be submitted only electronically without the submission of a physical file of supporting documents through the Integrated State Aid Management Information System (ISMS).

The evaluation of funding applications is carried out by the direct procedure (FiFo) and investment projects will be examined in the order in which they are submitted until the budget of the Action is exhausted and in any case until the expiry of the Regulation. Initially, the eligibility criteria will be checked and then eligible projects will be scored on the basis of criteria set out in the detailed Call and related to :

- the existing employment

- the change in Turnover, Exports and Operating Profitability

- the amount of the subsidised budget of the proposed investment in relation to the company's turnover (low-risk and low-uncertainty investments are encouraged)

- the place where the investment is to be carried out (priority will be given to investments carried out in special areas/ mountainous, disadvantaged or island areas)

- the relevance of the Investment Plan of the Company with the National Smart Specialization Strategy 2021-2027

The minimum qualifying score is set at 40.

Please note that applications for funding can be submitted either only under Action 1 - Green Transformation of SMEs or only under Action 2 - Green Productive Investment of SMEs.

Χρήσιμα αρχεία

Χρήσιμα αρχεία

22/03/2023

1st amendment to the Call for Funding Applications

07/03/2023

Call for Proposals "Green Productive Investment for SMEs"

07/03/2023

Application documents

19/12/2022

Pre-publication of Action "Green Productive Investment for SMEs"